A planned giving program is something all nonprofits should consider starting. Planned giving programs – sometimes called legacy giving – help donors make plans to leave money or assets to a nonprofit at a future date, both during their lifetimes and after death in their will.

A planned giving program allows your nonprofit to build strong relationships with your donors by being a part of their estate planning and legacy giving through a bequest, or another type of planned gift.

What is Planned Giving

As the name suggests, planned gifts are donations that are set up now to be donated at a future date. Planned giving donations are usually arranged for after a donor has passed away, and can also be referred to as legacy giving.

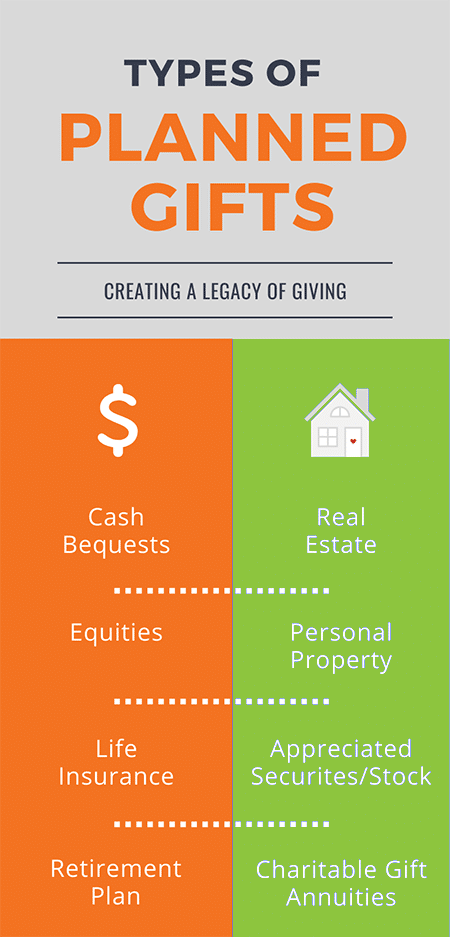

While legacy gifts are often made as a bequest in a donor’s will, they can take other forms as well. This includes gifts of life insurance, charitable annuities, charitable remainder trusts, and gifts of stocks or securities.

Planned giving terms and definitions

Bequest

A bequest is a gift made to a nonprofit in a donor’s will. Bequests are received by your nonprofit after the donor has passed and their will is executed.

Bequest intention

This is the donor’s notice that they intend to make a planned gift. This is not legally binding, but it means your nonprofit can expect the future donation and your planned giving officer can thank these donors.

Bequest expectancy

The approximate value of future planned gifts based on previous planned gifts made to your nonprofit. Bequest expectancy can help you conduct your business planning and budgeting for your planned giving program.

Planned gift notification

This is the official notification that your nonprofit will be receiving a planned gift, for a bequest in a will this will come after the donor has passed. It can take some time to find out what the exact amount is and then receive the donation.

Especially if the donor has pledged a percentage of their assets, it will take some time for your nonprofit to find out the final amount.

Non-cash assets

Simply put, this is a gift that is not cash. Planned gifts and legacy giving can also be donated through stocks, life insurance policies, retirement accounts or property.

Property

Real property refers to land and anything that is on the land such as buildings and the rights associated with that land.

Why donors engage in planned giving

Donors engage in planned giving or legacy giving for multiple reasons, and every donor’s motivations will be different. Generally, donors engage in planned giving programs because:

- Donors care about your mission and planned giving gives them a way to make a transformational donation

- Donors can leave a lifetime gift to your nonprofit that they would not be able to make during their lifetimes

- As donors plan their estates, legacy giving and bequests give them an opportunity to leave a lasting legacy

A planned giving program is a beautiful opportunity for donors to engage with your nonprofit and build your mission into their lifetime legacy.

Why Start a Planned Giving Program

There are many reasons why your nonprofit should start a Planned Giving Program and they range from the benefits to your nonprofit, to being a great way for your donors to build a deeper relationship with your organization.

Additional revenue for your nonprofit

The most obvious reason to start a planned giving program is to bring in more revenue for your nonprofit, but you have probably been underestimating how much revenue can come in from planned gifts.

- Baby boomers are set to pass on $59 trillion between now and 2065 as they age and pass on

- In the United States, 9.6% of charitable giving revenue in 2019 was donated through bequests

- While it’s hard to determine an average for legacy and planned gifts, a study showed that the average bequest donation was $78,630

A meaningful opportunity for donors

Some of your most loyal donors are your monthly and annual mid-level donors that continue to give for many years. Your nonprofit and its mission are obviously very important to them, but they don’t have the disposable income while they’re alive to give you a major gift.

A study on planned giving by Giving USA revealed that 78% of respondents who had made a planned gift have a history of giving to that organization over the past 20 years!

Legacy giving offers these donors an option to make a transformational gift to your charity as their legacy by leaving a bequest in their will. When your nonprofit has a planned giving program for these donors to engage in, it gives them an opportunity to support your nonprofit with a legacy gift.

Build strong donor relationships with planned giving

Donors who have set up legacy gifts and bequests for your nonprofit are invested in your nonprofit’s future. A planned giving program is an excellent opportunity for you to build a long term relationship with your supporters.

As Ambassadors

Planned giving donors make great ambassadors not just for your planned giving program, but for your nonprofit as a whole. As ambassadors your planned giving donors can:

- Help promote your planned giving program, legacy giving, and bequests

- Build trust with prospective donors that your nonprofit’s mission is a worthy cause

- Show that people who donate to your nonprofit are proud of their investment in your mission

As donors

Just because someone is leaving you a legacy gift or bequest in their will through your planned giving program doesn’t mean they won’t consider supporting your nonprofit as a donor for the remainder of their life.

In fact, your planned giving donors are more inclined to continue to support your nonprofit, 45% of planned giving donors also increase their annual donations to that nonprofit organization.

A donor’s legacy gift through your planned giving program increases their lifetime value to your nonprofit by increasing their likelihood to give, and the level of their support, in the future.

How to Start a Planned Giving Program

Starting a planned giving program can feel overwhelming, since there is a lot of policy and process involved in planned giving. But with a few straightforward steps, you can start your program on the right foot and learn the ins and outs as you go.

Support from leadership

It will be helpful to have the support of senior leadership and your board when you’re starting a planned giving program for your nonprofit.

If your board is involved in revenue development and assists with generating donations, they can help build relationships with prospective planned giving donors as you build the planned giving program.

Start a planned giving committee

As there is a lot of process and policies involved in planned giving that stretch beyond fundraising knowledge, like tax regulations, legal considerations, and more, it can be helpful to have a committee that includes members of your board who may have experience with these matters.

In addition to helping create the program and figure out policies and process, your committee can help your planned giving program by:

- Helping to identify new planned giving prospects

- Spreading the word about your nonprofits planned giving program

- As planned gift or legacy gift donors themselves

Building a new planned giving program is a lot of work. If you’re a small team, a dedicated committee of senior volunteers can really help you get started.

Create clear policies

Policies are important in most areas of the work that your nonprofit does, especially revenue development policies, and planned giving is no exception. In fact, due to the nature of planned gifts there is probably more policy and process involved than other areas of revenue development.

Here are some of the key policies you need to consider for starting a planned giving program:

- Gift acceptance policy

- Sample language for donors to use when leaving gifts in their wills

- Process for administration for the program and processing bequests and other planned gifts

- Processes and policies for soliciting and stewarding planned gifts

- Policies for recognition and stewardship of planned gifts

- Communication plans and donor journeys for planned giving prospects and confirmed legacy donors

Planned giving business planning: set your budget and goals

Like any revenue development program at your nonprofit you’ll need to set a budget and goals when you start a planned giving program.

- Make sure your revenue goals are realistic, there’s nothing inspiring about an impossible goal

- Planned giving is a long game so, in addition to revenue goals, set goals that are attainable in year one of your program

- Identifying a certain number of prospects

- Reaching a certain number of donors to inform them about your new planned giving program

- Receiving confirmation from a certain number of donors that they are including your nonprofit in their will or stating their intention to

- Set a realistic budget, keeping in mind that starting a planned giving program is a long term investment for your nonprofit

Write a case for support

Just like any area of fundraising, your planned giving program needs a strong case for support. If you already have a case for support for your nonprofit then all you need to do is tailor it slightly for legacy giving and bequests.

- Show how a donor’s bequest in their will can be a legacy that changes lives

- Tell donors about the impact of your nonprofit with personal stories mixed in with statistics

- Include stories of legacy giving, bequest, and planned giving donors as ambassadors for your nonprofit

How to identify planned giving prospects

The best place to start with identifying planned giving prospects is within your own nonprofit database. Look for:

- Donors who have given to you before and have been loyal donors over many years.

- Donors with a longstanding relationship with your nonprofit

- Donors who are committed and passionate to your mission

- Displayed through many years of giving

- Volunteer work

- Ambassadors for your nonprofit

- People positively affected by your mission, these could be beneficiaries of your nonprofit

With Sumac CRM, it’s easy to generate these report.

It’s also important to consider demographics when identifying planned giving prospects. Look for prospects who are:

- Older in age, the average donor in this study was 58 years old when they made their first planned gift

- Have appreciated property which can be an indicator of wealth and propensity to make a planned gift or bequest

- People who are single or widowed, married people and even couples can make planned gifts, but when someone is married they are likely to leave the majority of their assets to their spouse. Single or widowed people have more flexibility in allocating their assets

Appointing a planned giving officer

A planned giving program needs to have at least one officer who will meet with prospective donors, manage relationships, and steward planned giving donors and their families. Your nonprofit will need to consider the skill set required in a planned giving officer to fill this important role.

- Experience with fundraising and soliciting major gifts, as well as maintaining relationships and stewarding donors

- Proven track record in successfully soliciting major gifts ($10,000 and above, depending on your nonprofit size)

- Marketing and communications experience will be an asset for planned giving marketing strategy

- Knowledge of planned giving processes and terms

Planned Giving Marketing

Once you’ve got your planned giving program in place, you’ll need to spread the word through marketing. Planned giving takes a lot of consideration from donors and requires them to be informed, so it’s important that you have a strong strategy for planned giving marketing.

Integrate planned giving into your nonprofit marketing

The best way you can start to market your planned giving program is to integrate planned giving messaging into your current marketing. Here are some areas where you can integrate planned giving:

- Direct mail packages – remember your best planned giving and legacy giving prospects are your loyal donors

- Planned giving brochure – create a brochure that gift officers can give to prospects during meetings

- On your website – leverage your ways to give section to include planned giving information

- Social media – posting on social media is a great way to spread awareness about your planned giving program

- In your newsletter

Planned giving marketing on your website

Your nonprofit’s website is the first place someone is going to go to find information about your planned giving options. Planned giving marketing on your website starts with ensuring it has a presence and the information that lawyers, stock brokers, and most importantly, donors need is easy to find.

- Make sure contact information and your charitable registration number is easy to find

- Include planned giving and legacy gifts on your ways to give page so donors are aware of this option

- Make links to transfer forms for gifts of stock and securities easy to find

- Provide the direct contact information for a staff person who can provide more information and answer questions

It’s also a good idea for planned giving marketing to include standard language on your website that donors can use to name your nonprofit in their will. Make sure you have this vetted by your legal team to make sure it follows all laws and regulations.

Check out this example from Doctors Without Borders of how to provide sample wording for donors to use in their wills.

Planned giving marketing materials

Providing information about planned giving on your website is a great place to start, but to really spread the word you should develop other marketing materials like a planned giving brochure.

Planned giving brochure

A planned giving brochure is a great strategy for planned giving marketing. A planned giving brochure gives donors something physical they can hang on to and reference later when they are planning their estate.

What to include in your planned giving brochure

- Contact information for your planned giving team

- For a physical piece consider using a general phone line and mailbox so that it’s not tied to a specific staff member who may move on to a new role

- Planned giving case for support

- Ambassador story from a confirmed bequest donor

- Charitable registration number and other information needed for naming your nonprofit in a will

How to use your planned giving brochure

- Provide it to relationship managers, even those working outside of planned giving, so they can share it with their donors

- Have the planned giving brochure available in your reception or waiting area

- Keep in mind that legacy gifts and bequests are a great option for annual level donors, and your beneficiaries who want to give back

- Ask local law firms if they will display your planned giving brochure if they have an area for their clients to access information about estate planning

- Slip your planned giving brochure into your tax receipt packages when you’re sending tax receipts out

- Your loyal annual donors are great prospects for legacy gifts and bequests

The best way to let donors know about your planned giving program is to just keep talking about your planned giving program in all of your nonprofit marketing channels and face-to-face meetings – 70% of planned giving donors made their gifts because they were asked!

Examples of Successful Planned Giving Programs

A great way to get inspiration for your own planned giving program and marketing is to look at great examples from your nonprofit peers, and your competition. Here are a couple successful planning giving program examples that are covering all the stops with their planned giving marketing and strategy.

#1 World Vision Canada

The way World Vision Canada has set up their planned giving webpage is so organized and easy for supporters to navigate. It’s more than just an information page, it’s a whole online portal for prospective legacy giving, bequest and planned giving donors to find the information that they need.

All of the areas of planned giving are listed and it’s really easy to find information about all of them beyond legacy giving and bequests

Besides providing clear information, the World Vision Canada planned giving portal shows the impact of legacy giving, bequests, and planned gifts with dynamic photography that showcases their unique mission.

#2 Sick Kids Foundation

The Sick Kids Foundation is another great example of a planned giving web portal. This page is specific for legacy giving and bequests in wills, and provides all the information a prospective donor needs, while highlighting the Sick Kids mission and the impact of planned giving donations.

Linked on the bottom of the legacy giving and bequests page are the other methods of planned giving that a donor may consider.

The Sick Kids Foundation is making a compelling case for legacy giving and bequests while presenting all the information required and the other ways a donor can participate in planned giving.

However, it’s more than the information that makes this planned giving web page great, they are also putting their mission front and center, and using a donor ambassador to talk about legacy giving.

Planned Giving and Endowments

You can leverage your planned giving program alongside a nonprofit endowment fund to maximize the return from your planned giving strategy. Investing legacy giving, bequests, and other planned gifts into an endowment fund also gives donors an opportunity to maximize the impact of their planned gifts.

What is an endowment fund

A nonprofit endowment fund is money that is invested with the purpose of generating income over time. The income from the investment may be used over time to fund the nonprofit’s mission, while the initial investment remains untouched and continues to grow and generate income over time.

Restricted endowments

Restricted nonprofit endowment funds are when the money is designated for a specific purpose. All income from a restricted nonprofit endowment fund must be restricted to that purpose.

Restricted funds can be designated towards any part of your nonprofit’s mission and programs.

Caution must be exercised when donors want to make their planned gift or bequest to a restricted endowment fund. If it is for a purpose your nonprofit will struggle to execute, or that may not have longevity within your mission or programming, it may be better to turn down the gift.

General endowments

Unlike restricted nonprofit endowment funds general endowment funds can be used for any purpose related to your mission. Including operating and administrative costs to keep your nonprofit running.

This makes general endowment funds preferable over restricted endowment funds for providing long term and flexible funding to your nonprofit.

How planned giving is connected to endowments

When a planned giving donor is making a legacy gift or a bequest in their will they are seeking to leave a lasting legacy after their death.

Endowment funds are long term investments so this goes well with the idea of leaving a lasting legacy.

Extend a donor’s legacy

When donors make their legacy gift, planned gift, or bequest to an endowment fund, they have a sense of certainty that their legacy will be long lasting as that endowment fund will continue to generate revenue for your nonprofit for years and years to come.

Maximize a donor’s legacy

Over time as the endowment fund continues to grow and your nonprofit continues to receive income from the fund, the impact of the endowment fund will be much more than the initial legacy gift or bequest that the donor was able to make.

A planned gift to a nonprofit endowment fund can help donors make an even bigger impact over time with their gift.

An opportunity for loved ones to honour a donor’s memory

Nonprofit endowment funds can be added to overtime to grow the size of the investment. This gives a donor’s family and friends the opportunity to contribute to their legacy gift after they have passed.

Friends and family can make additional gifts to the nonprofit endowment fund in memory of the donor who has passed, engaging these new donors with your mission and honouring the memory of their loved one who has passed.

Planned giving is much more than just legacy giving and bequests in wills, a planned giving program is a great source of revenue for nonprofits. And beyond the revenue opportunities, it is an opportunity to build stronger relationships with your donors and their families.

A planned giving program is something all nonprofits should consider starting. Planned giving programs – sometimes called legacy giving – help donors make plans to leave money or assets to a nonprofit at a future date, both during their lifetimes and after death in their will.

A planned giving program allows your nonprofit to build strong relationships with your donors by being a part of their estate planning and legacy giving through a bequest, or another type of planned gift.

This complete planned giving guide for nonprofits will cover:

- What is planned giving

- Why start a planned giving program

- How to start a planned giving program, including how to identify planning giving prospects

- How to develop a planned giving marketing strategy

- Examples of successful planned giving programs

- How to connect planned giving with a nonprofit endowment fund

What is Planned Giving

As the name suggests, planned gifts are donations that are set up now to be donated at a future date. Planned giving donations are usually arranged for after a donor has passed away, and can also be referred to as legacy giving.

While legacy gifts are often made as a bequest in a donor’s will, they can take other forms as well. This includes gifts of life insurance, charitable annuities, charitable remainder trusts, and gifts of stocks or securities.

Planned giving terms and definitions

Bequest

A bequest is a gift made to a nonprofit in a donor’s will. Bequests are received by your nonprofit after the donor has passed and their will is executed.

Bequest intention

This is the donor’s notice that they intend to make a planned gift. This is not legally binding, but it means your nonprofit can expect the future donation and your planned giving officer can thank these donors.

Bequest expectancy

The approximate value of future planned gifts based on previous planned gifts made to your nonprofit. Bequest expectancy can help you conduct your business planning and budgeting for your planned giving program.

Planned gift notification

This is the official notification that your nonprofit will be receiving a planned gift, for a bequest in a will this will come after the donor has passed. It can take some time to find out what the exact amount is and then receive the donation.

Especially if the donor has pledged a percentage of their assets, it will take some time for your nonprofit to find out the final amount.

Non-cash assets

Simply put, this is a gift that is not cash. Planned gifts and legacy giving can also be donated through stocks, life insurance policies, retirement accounts or property.

Property

Real property refers to land and anything that is on the land such as buildings and the rights associated with that land.

Why donors engage in planned giving

Donors engage in planned giving or legacy giving for multiple reasons, and every donor’s motivations will be different. Generally, donors engage in planned giving programs because:

- Donors care about your mission and planned giving gives them a way to make a transformational donation

- Donors can leave a lifetime gift to your nonprofit that they would not be able to make during their lifetimes

- As donors plan their estates, legacy giving and bequests give them an opportunity to leave a lasting legacy

A planned giving program is a beautiful opportunity for donors to engage with your nonprofit and build your mission into their lifetime legacy.

Why Start a Planned Giving Program

There are many reasons why your nonprofit should start a Planned Giving Program and they range from the benefits to your nonprofit, to being a great way for your donors to build a deeper relationship with your organization.

Additional revenue for your nonprofit

The most obvious reason to start a planned giving program is to bring in more revenue for your nonprofit, but you have probably been underestimating how much revenue can come in from planned gifts.

- Baby boomers are set to pass on $59 trillion between now and 2065 as they age and pass on

- In the United States, 9.6% of charitable giving revenue in 2019 was donated through bequests

- While it’s hard to determine an average for legacy and planned gifts, a study showed that the average bequest donation was $78,630

A meaningful opportunity for donors

Some of your most loyal donors are your monthly and annual mid-level donors that continue to give for many years. Your nonprofit and its mission are obviously very important to them, but they don’t have the disposable income while they’re alive to give you a major gift.

A study on planned giving by Giving USA revealed that 78% of respondents who had made a planned gift have a history of giving to that organization over the past 20 years!

Legacy giving offers these donors an option to make a transformational gift to your charity as their legacy by leaving a bequest in their will. When your nonprofit has a planned giving program for these donors to engage in, it gives them an opportunity to support your nonprofit with a legacy gift.

Build strong donor relationships with planned giving

Donors who have set up legacy gifts and bequests for your nonprofit are invested in your nonprofit’s future. A planned giving program is an excellent opportunity for you to build a long term relationship with your supporters.

As Ambassadors

Planned giving donors make great ambassadors not just for your planned giving program, but for your nonprofit as a whole. As ambassadors your planned giving donors can:

- Help promote your planned giving program, legacy giving, and bequests

- Build trust with prospective donors that your nonprofit’s mission is a worthy cause

- Show that people who donate to your nonprofit are proud of their investment in your mission

As donors

Just because someone is leaving you a legacy gift or bequest in their will through your planned giving program doesn’t mean they won’t consider supporting your nonprofit as a donor for the remainder of their life.

In fact, your planned giving donors are more inclined to continue to support your nonprofit, 45% of planned giving donors also increase their annual donations to that nonprofit organization.

A donor’s legacy gift through your planned giving program increases their lifetime value to your nonprofit by increasing their likelihood to give, and the level of their support, in the future.

How to Start a Planned Giving Program

Starting a planned giving program can feel overwhelming, since there is a lot of policy and process involved in planned giving. But with a few straightforward steps, you can start your program on the right foot and learn the ins and outs as you go.

Support from leadership

It will be helpful to have the support of senior leadership and your board when you’re starting a planned giving program for your nonprofit.

If your board is involved in revenue development and assists with generating donations, they can help build relationships with prospective planned giving donors as you build the planned giving program.

Start a planned giving committee

As there is a lot of process and policies involved in planned giving that stretch beyond fundraising knowledge, like tax regulations, legal considerations, and more, it can be helpful to have a committee that includes members of your board who may have experience with these matters.

In addition to helping create the program and figure out policies and process, your committee can help your planned giving program by:

- Helping to identify new planned giving prospects

- Spreading the word about your nonprofits planned giving program

- As planned gift or legacy gift donors themselves

Building a new planned giving program is a lot of work. If you’re a small team, a dedicated committee of senior volunteers can really help you get started.

Create clear policies

Policies are important in most areas of the work that your nonprofit does, especially revenue development policies, and planned giving is no exception. In fact, due to the nature of planned gifts there is probably more policy and process involved than other areas of revenue development.

Here are some of the key policies you need to consider for starting a planned giving program:

- Gift acceptance policy

- Sample language for donors to use when leaving gifts in their wills

- Process for administration for the program and processing bequests and other planned gifts

- Processes and policies for soliciting and stewarding planned gifts

- Policies for recognition and stewardship of planned gifts

- Communication plans and donor journeys for planned giving prospects and confirmed legacy donors

Planned giving business planning: set your budget and goals

Like any revenue development program at your nonprofit you’ll need to set a budget and goals when you start a planned giving program.

- Make sure your revenue goals are realistic, there’s nothing inspiring about an impossible goal

- Planned giving is a long game so, in addition to revenue goals, set goals that are attainable in year one of your program

- Identifying a certain number of prospects

- Reaching a certain number of donors to inform them about your new planned giving program

- Receiving confirmation from a certain number of donors that they are including your nonprofit in their will or stating their intention to

- Set a realistic budget, keeping in mind that starting a planned giving program is a long term investment for your nonprofit

Write a case for support

Just like any area of fundraising, your planned giving program needs a strong case for support. If you already have a case for support for your nonprofit then all you need to do is tailor it slightly for legacy giving and bequests.

- Show how a donor’s bequest in their will can be a legacy that changes lives

- Tell donors about the impact of your nonprofit with personal stories mixed in with statistics

- Include stories of legacy giving, bequest, and planned giving donors as ambassadors for your nonprofit

How to identify planned giving prospects

The best place to start with identifying planned giving prospects is within your own nonprofit database. Look for:

- Donors who have given to you before and have been loyal donors over many years.

- Donors with a longstanding relationship with your nonprofit

- Donors who are committed and passionate to your mission

- Displayed through many years of giving

- Volunteer work

- Ambassadors for your nonprofit

- People positively affected by your mission, these could be beneficiaries of your nonprofit

With Sumac CRM, it’s easy to generate these report.

It’s also important to consider demographics when identifying planned giving prospects. Look for prospects who are:

- Older in age, the average donor in this study was 58 years old when they made their first planned gift

- Have appreciated property which can be an indicator of wealth and propensity to make a planned gift or bequest

- People who are single or widowed, married people and even couples can make planned gifts, but when someone is married they are likely to leave the majority of their assets to their spouse. Single or widowed people have more flexibility in allocating their assets

Appointing a planned giving officer

A planned giving program needs to have at least one officer who will meet with prospective donors, manage relationships, and steward planned giving donors and their families. Your nonprofit will need to consider the skill set required in a planned giving officer to fill this important role.

- Experience with fundraising and soliciting major gifts, as well as maintaining relationships and stewarding donors

- Proven track record in successfully soliciting major gifts ($10,000 and above, depending on your nonprofit size)

- Marketing and communications experience will be an asset for planned giving marketing strategy

- Knowledge of planned giving processes and terms

Planned Giving Marketing

Once you’ve got your planned giving program in place, you’ll need to spread the word through marketing. Planned giving takes a lot of consideration from donors and requires them to be informed, so it’s important that you have a strong strategy for planned giving marketing.

Integrate planned giving into your nonprofit marketing

The best way you can start to market your planned giving program is to integrate planned giving messaging into your current marketing. Here are some areas where you can integrate planned giving:

- Direct mail packages – remember your best planned giving and legacy giving prospects are your loyal donors

- Planned giving brochure – create a brochure that gift officers can give to prospects during meetings

- On your website – leverage your ways to give section to include planned giving information

- Social media – posting on social media is a great way to spread awareness about your planned giving program

- In your newsletter

Planned giving marketing on your website

Your nonprofit’s website is the first place someone is going to go to find information about your planned giving options. Planned giving marketing on your website starts with ensuring it has a presence and the information that lawyers, stock brokers, and most importantly, donors need is easy to find.

- Make sure contact information and your charitable registration number is easy to find

- Include planned giving and legacy gifts on your ways to give page so donors are aware of this option

- Make links to transfer forms for gifts of stock and securities easy to find

- Provide the direct contact information for a staff person who can provide more information and answer questions

It’s also a good idea for planned giving marketing to include standard language on your website that donors can use to name your nonprofit in their will. Make sure you have this vetted by your legal team to make sure it follows all laws and regulations.

Check out this example from Doctors Without Borders of how to provide sample wording for donors to use in their wills.

Planned giving marketing materials

Providing information about planned giving on your website is a great place to start, but to really spread the word you should develop other marketing materials like a planned giving brochure.

Planned giving brochure

A planned giving brochure is a great strategy for planned giving marketing. A planned giving brochure gives donors something physical they can hang on to and reference later when they are planning their estate.

What to include in your planned giving brochure

- Contact information for your planned giving team

- For a physical piece consider using a general phone line and mailbox so that it’s not tied to a specific staff member who may move on to a new role

- Planned giving case for support

- Ambassador story from a confirmed bequest donor

- Charitable registration number and other information needed for naming your nonprofit in a will

How to use your planned giving brochure

- Provide it to relationship managers, even those working outside of planned giving, so they can share it with their donors

- Have the planned giving brochure available in your reception or waiting area

- Keep in mind that legacy gifts and bequests are a great option for annual level donors, and your beneficiaries who want to give back

- Ask local law firms if they will display your planned giving brochure if they have an area for their clients to access information about estate planning

- Slip your planned giving brochure into your tax receipt packages when you’re sending tax receipts out

- Your loyal annual donors are great prospects for legacy gifts and bequests

The best way to let donors know about your planned giving program is to just keep talking about your planned giving program in all of your nonprofit marketing channels and face-to-face meetings – 70% of planned giving donors made their gifts because they were asked!

Examples of Successful Planned Giving Programs

A great way to get inspiration for your own planned giving program and marketing is to look at great examples from your nonprofit peers, and your competition. Here are a couple successful planning giving program examples that are covering all the stops with their planned giving marketing and strategy.

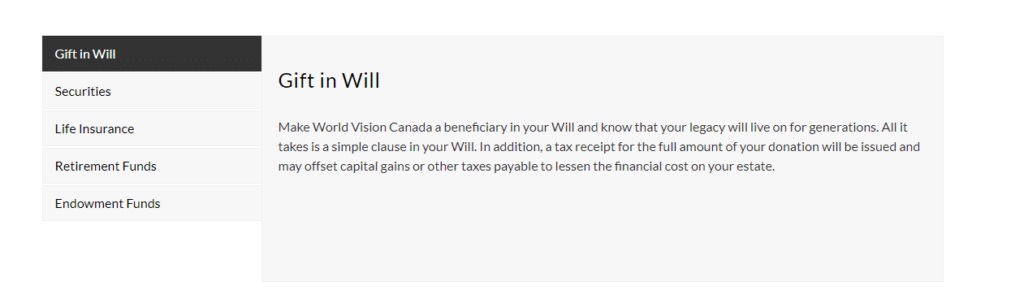

#1 World Vision Canada

The way World Vision Canada has set up their planned giving webpage is so organized and easy for supporters to navigate. It’s more than just an information page, it’s a whole online portal for prospective legacy giving, bequest and planned giving donors to find the information that they need.

All of the areas of planned giving are listed and it’s really easy to find information about all of them beyond legacy giving and bequests.

Besides providing clear information, the World Vision Canada planned giving portal shows the impact of legacy giving, bequests, and planned gifts with dynamic photography that showcases their unique mission.

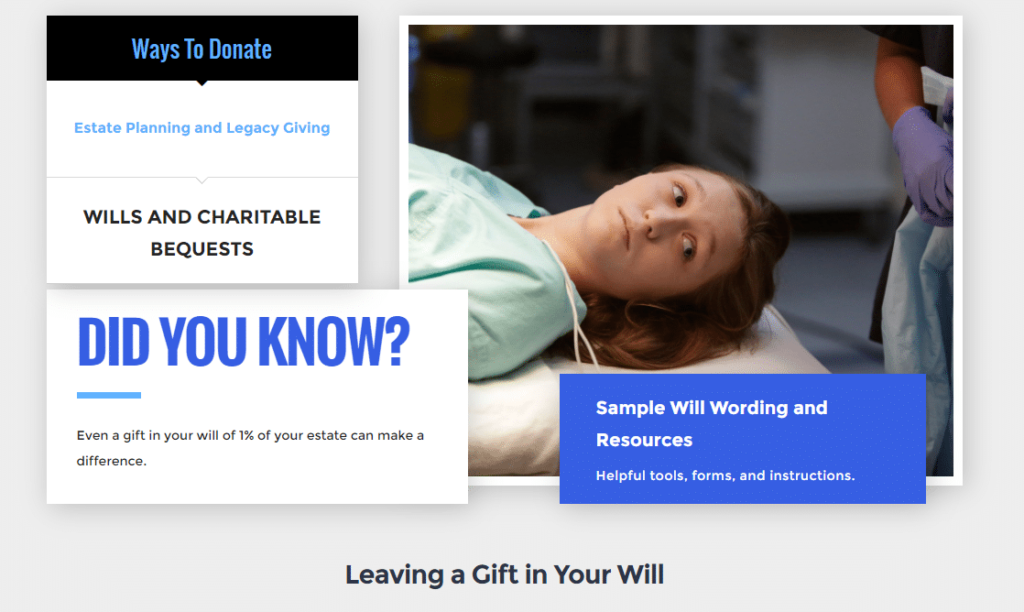

#2 Sick Kids Foundation

The Sick Kids Foundation is another great example of a planned giving web portal. This page is specific for legacy giving and bequests in wills, and provides all the information a prospective donor needs, while highlighting the Sick Kids mission and the impact of planned giving donations.

Linked on the bottom of the legacy giving and bequests page are the other methods of planned giving that a donor may consider.

The Sick Kids Foundation is making a compelling case for legacy giving and bequests while presenting all the information required and the other ways a donor can participate in planned giving.

However, it’s more than the information that makes this planned giving web page great, they are also putting their mission front and center, and using a donor ambassador to talk about legacy giving.

Planned Giving and Endowments

You can leverage your planned giving program alongside a nonprofit endowment fund to maximize the return from your planned giving strategy. Investing legacy giving, bequests, and other planned gifts into an endowment fund also gives donors an opportunity to maximize the impact of their planned gifts.

What is an endowment fund

A nonprofit endowment fund is money that is invested with the purpose of generating income over time. The income from the investment may be used over time to fund the nonprofit’s mission, while the initial investment remains untouched and continues to grow and generate income over time.

Restricted endowments

Restricted nonprofit endowment funds are when the money is designated for a specific purpose. All income from a restricted nonprofit endowment fund must be restricted to that purpose.

Restricted funds can be designated towards any part of your nonprofit’s mission and programs.

Caution must be exercised when donors want to make their planned gift or bequest to a restricted endowment fund. If it is for a purpose your nonprofit will struggle to execute, or that may not have longevity within your mission or programming, it may be better to turn down the gift.

General endowments

Unlike restricted nonprofit endowment funds general endowment funds can be used for any purpose related to your mission. Including operating and administrative costs to keep your nonprofit running.

This makes general endowment funds preferable over restricted endowment funds for providing long term and flexible funding to your nonprofit.

How planned giving is connected to endowments

When a planned giving donor is making a legacy gift or a bequest in their will they are seeking to leave a lasting legacy after their death.

Endowment funds are long term investments so this goes well with the idea of leaving a lasting legacy.

Extend a donor’s legacy

When donors make their legacy gift, planned gift, or bequest to an endowment fund, they have a sense of certainty that their legacy will be long lasting as that endowment fund will continue to generate revenue for your nonprofit for years and years to come.

Maximize a donor’s legacy

Over time as the endowment fund continues to grow and your nonprofit continues to receive income from the fund, the impact of the endowment fund will be much more than the initial legacy gift or bequest that the donor was able to make.

A planned gift to a nonprofit endowment fund can help donors make an even bigger impact over time with their gift.

An opportunity for loved ones to honour a donor’s memory

Nonprofit endowment funds can be added to overtime to grow the size of the investment. This gives a donor’s family and friends the opportunity to contribute to their legacy gift after they have passed.

Friends and family can make additional gifts to the nonprofit endowment fund in memory of the donor who has passed, engaging these new donors with your mission and honouring the memory of their loved one who has passed.

Planned giving is much more than just legacy giving and bequests in wills, a planned giving program is a great source of revenue for nonprofits. And beyond the revenue opportunities, it is an opportunity to build stronger relationships with your donors and their families.